inheritance tax waiver nc

Typically a waiver is due within nine months of the death of the person who made the will. Inheritance Tax Waiver Nc.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

There is no inheritance tax in nc so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

. Registration of Inheritance and Estate Tax Waiver. Registration of Inheritance and Estate Tax Waiver. North Carolina Inheritance Tax and Gift Tax.

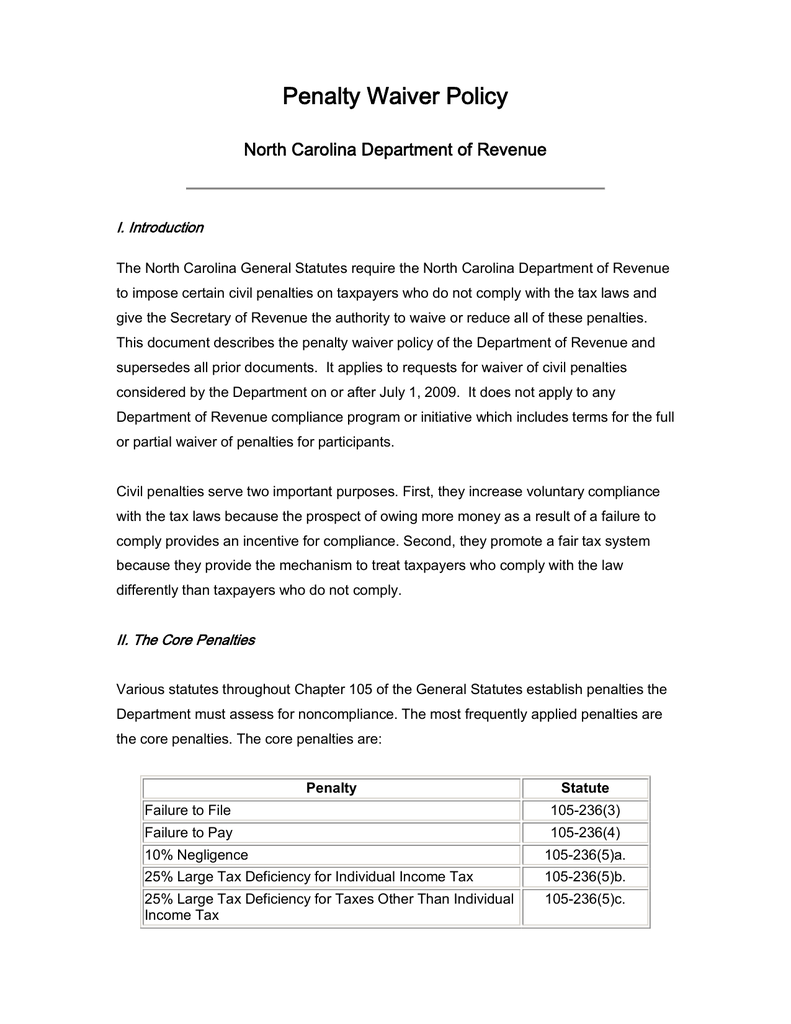

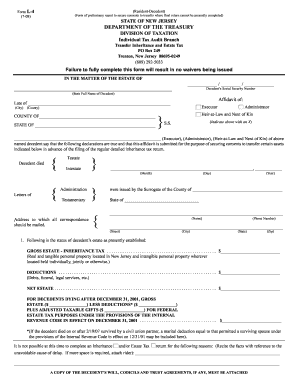

However this policy still applies to any of those taxes due prior to their repeal. An Inheritance and Estate Tax Waiver or other consent to transfer issued by the Secretary of Revenue bearing the signature of the Secretary of Revenue or the official facsimile signature of the Secretary of Revenue may be registered by the Register of Deeds in the county or counties where the real estate described in the Inheritance. The inheritance tax of another state may come into play for those living in North.

Tax Bulletins Directives Important Notices. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005. Use this form for a decedent who died before 111999.

Ad pdfFiller allows users to edit sign fill and share all type of documents online. In the general court of justice before the clerk in the matter of the estate of state of north carolina county note. There is no inheritance tax in North Carolina.

Find a courthouse Find my court date Pay my citation online. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. Opry Mills Breakfast Restaurants.

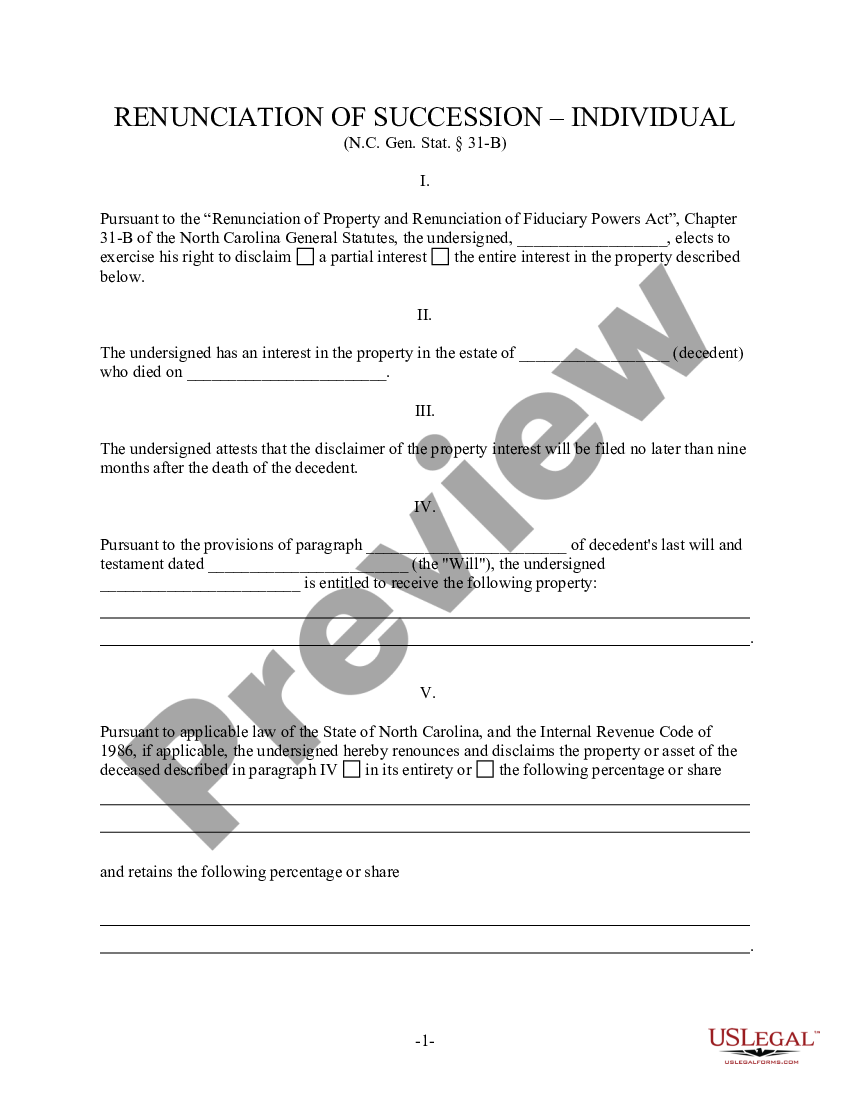

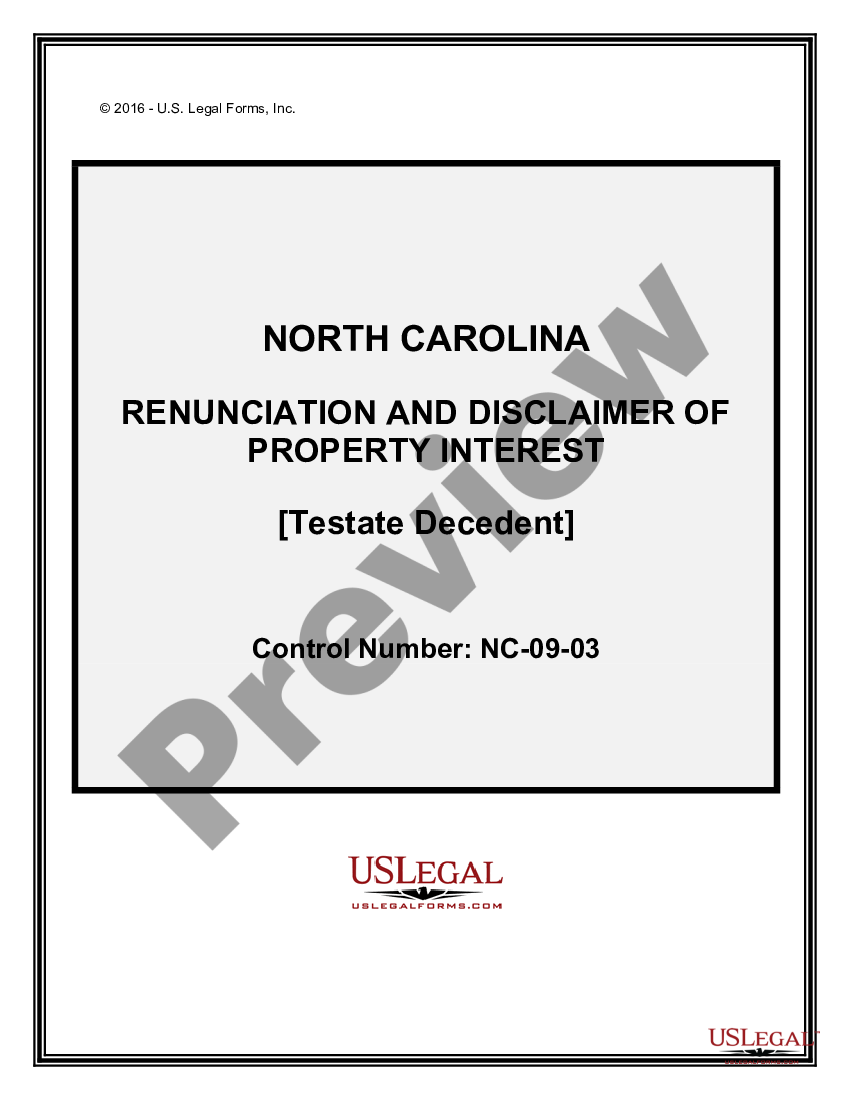

Important Notices and Frequently Asked Questions. Inheritance and estate tax certification north carolina judicial branch. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

Charitable educational and religious organizations as defined by the IRS are exempt from Iowa inheritance tax if they receive 500 or less but they must pay a flat 8 if. STATE OF NORTH CAROLINA County NOTE. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

Restaurants In Matthews Nc That Deliver. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. 1 PDF editor e-sign platform data collection form builder solution in a single app.

An Inheritance and Estate Tax Waiver or other consent to transfer issued by the Secretary of Revenue bearing the signature of the Secretary. The document is only necessary in. North Carolina Judicial Branch Search Menu Search.

Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate. North Carolina Department of Revenue. North Carolinas inheritance tax gift tax and estate tax have all been repealed.

However there are 2 important exceptions to this rule. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Inheritance And Estate Tax.

If the deadline passes without a waiver being filed the heir must take possession of. Inheritance Tax Waiver Nc. North Carolina does not collect an inheritance tax or an estate tax.

Income Tax Rate Indonesia. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

However state residents should remember to take into account the federal estate tax if their estate or the. Whether the form is needed depends on the state.

Penalty Waiver Policy North Carolina Department Of Revenue

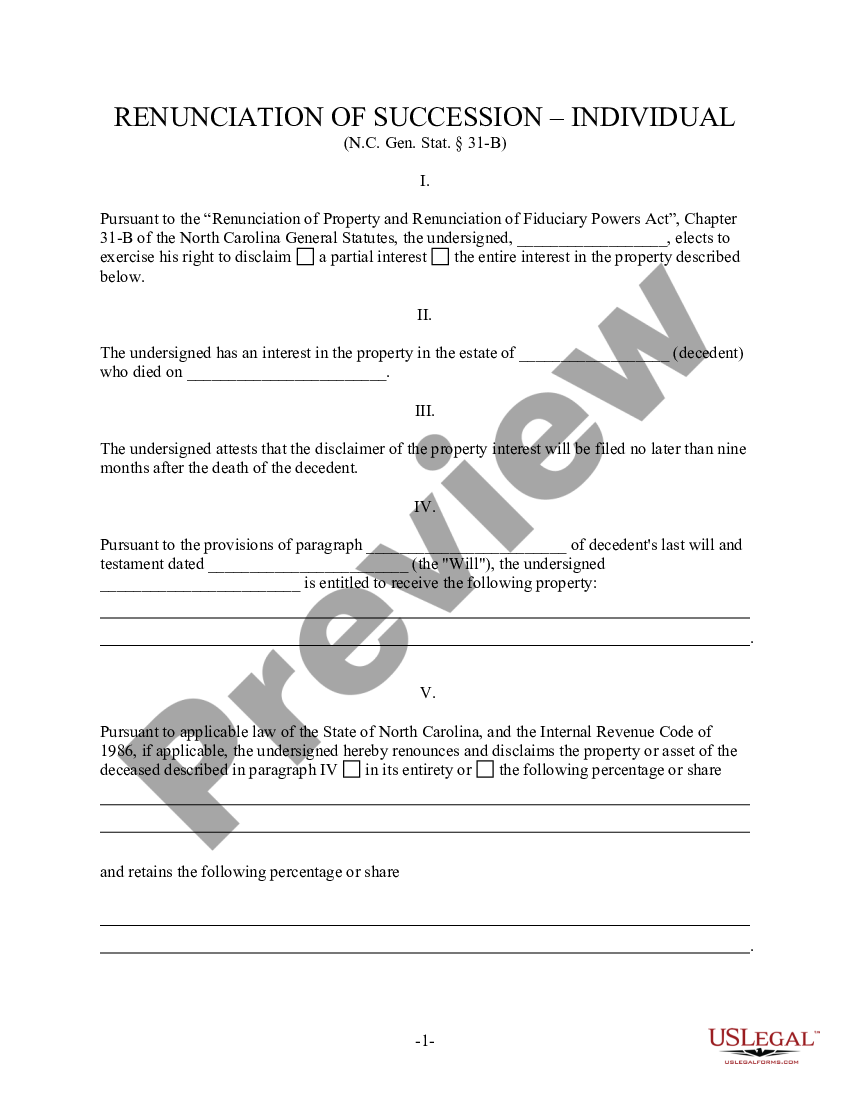

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Nc Us Legal Forms

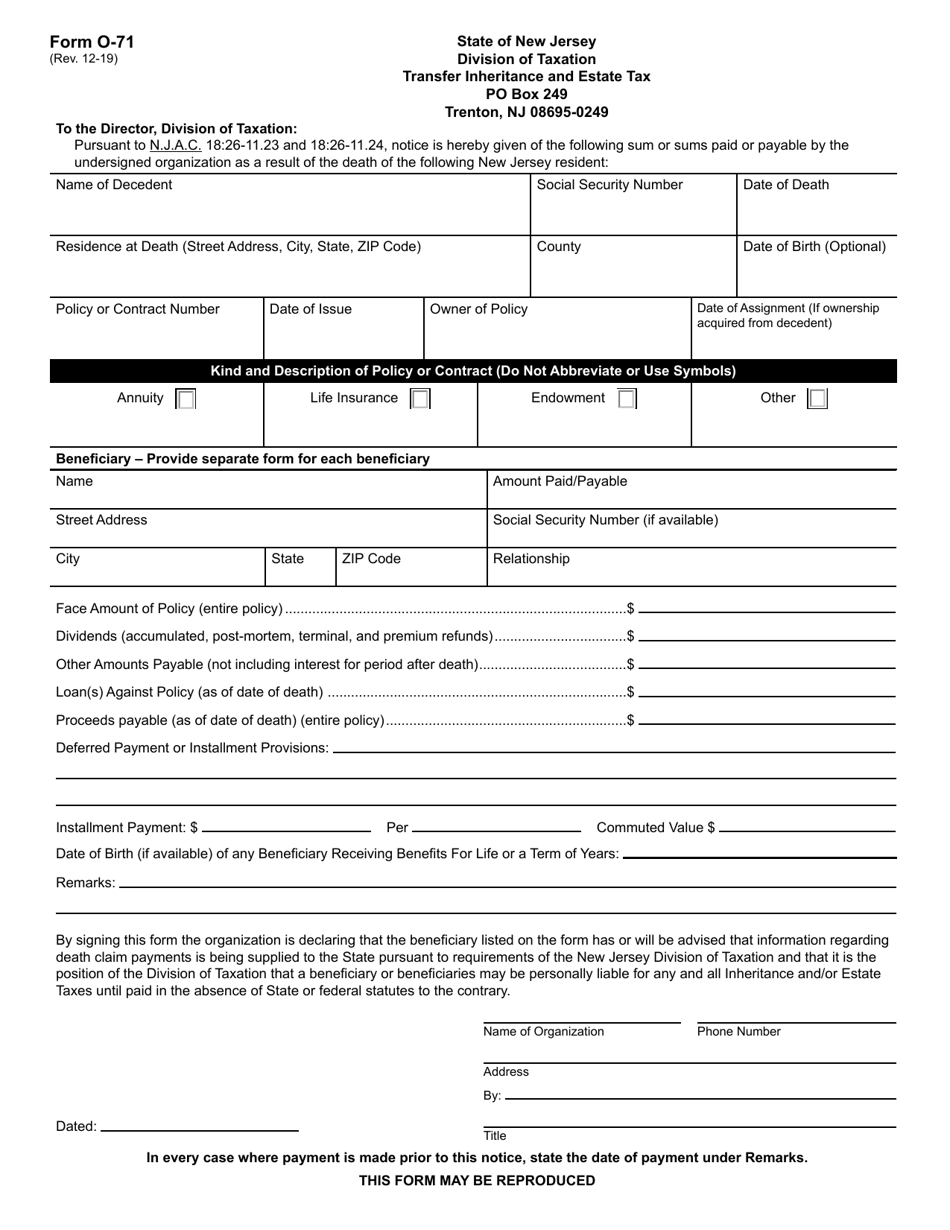

Nj Inheritance Waiver Tax Form 01 Pdf Fill Online Printable Fillable Blank Pdffiller

Form O 71 Download Fillable Pdf Or Fill Online Transfer Inheritance And Estate Tax New Jersey Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Nc Us Legal Forms

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Templates Tax Forms

North Carolina Estate Tax Everything You Need To Know Smartasset

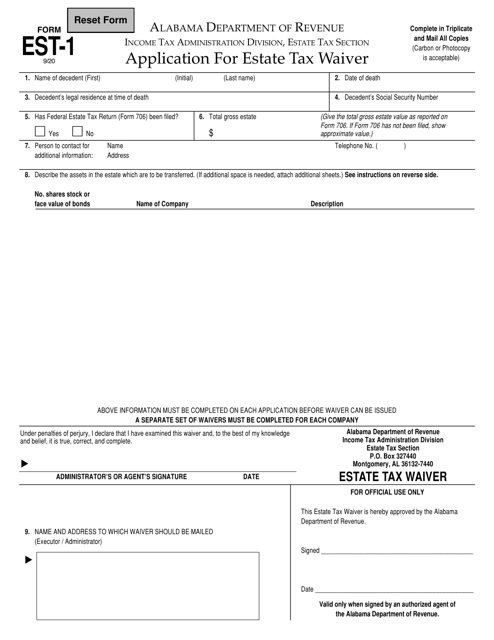

Form Est 1 Download Fillable Pdf Or Fill Online Application For Estate Tax Waiver Alabama Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

How Do State Estate And Inheritance Taxes Work Tax Policy Center

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc